santa clara property tax due date

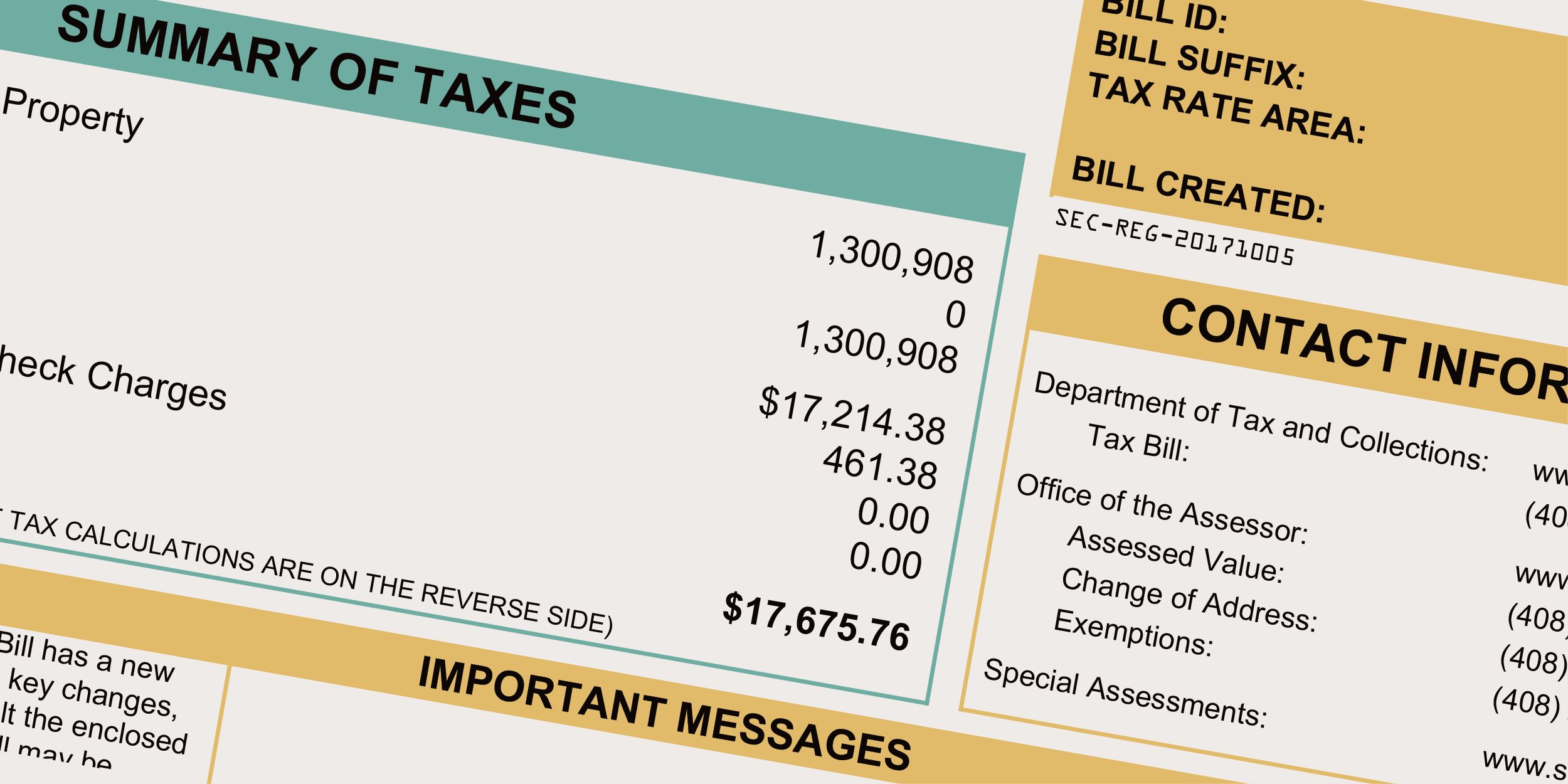

16 rows Assessed values on this lien date are the basis for the property tax bills that are due in. The County of Santa Clara assumes no responsibility arising from use of this information.

The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date.

. When not received the county assessors office should be. Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners. Novogratz brittany futon sofa April 26 2022 0 Comments 802 pm.

The Department of Tax and Collections in. Business Property Statements are due April 1. ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND either expressed or.

Business Property Statements are due April 1. The due date to file via mail e-filing or SDR remains the same. The payment for these bills must be received in our office or paid online by August 31.

If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the. Santa clara county property tax due date 2022. Second Installment of the 2021-2022 Annual Secured Property Taxes is Due February 1 and Becomes Delinquent after April 11.

Learn all about Santa Clara County real estate tax. January 22 2022 at 1200 PM. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due.

October 19 2020 at 1200 PM. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local. SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2020-2021 property taxes becomes.

SANTA CLARA COUNTY CALIF. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the. Unsecured bills mailed out throughout the year are due on the date shown on the payment coupon.

The due date to file via mail e-filing or SDR remains the same. MondayFriday 800 am 500 pm. Last Payment accepted at 445 pm Phone.

The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020.

5 Ways To Have Hope And Overcome Obstacles Overcoming 5 Ways Obstacles

Property Taxes Department Of Tax And Collections County Of Santa Clara

Https Www Facebook Com Christiansunitedforisrael Holocaust Remembrance Day Remembrance Day Remembrance

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Understanding California S Property Taxes

Santa Clara County Property Taxes Due Date Ke Andrews

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Be Sure To Visit Our Redesigned Donation Site Http Www 800charitycars Org Support Us With A Google Facebook Like Donation Sites Michelle Tax Deductions

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Catania Black Map Black White Map Art City Map Poster Italy City Map Print Map Poster Bm616

First Installment Of The 2021 2022 Annual Secured Property Taxes Due By December 10 And Becomes Delinquent After 5 P M The Bay Area Review

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Secured Property Taxes Treasurer Tax Collector

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire