tax incentives for electric cars in california

That being said California is giving credits to EV owners for an electric car home charger. Charge Ahead rebate of 5000 for purchase or lease of a new or.

What To Know About The Complicated Tax Credit For Electric Cars Npr

The amount of the credit will vary depending on the capacity of the.

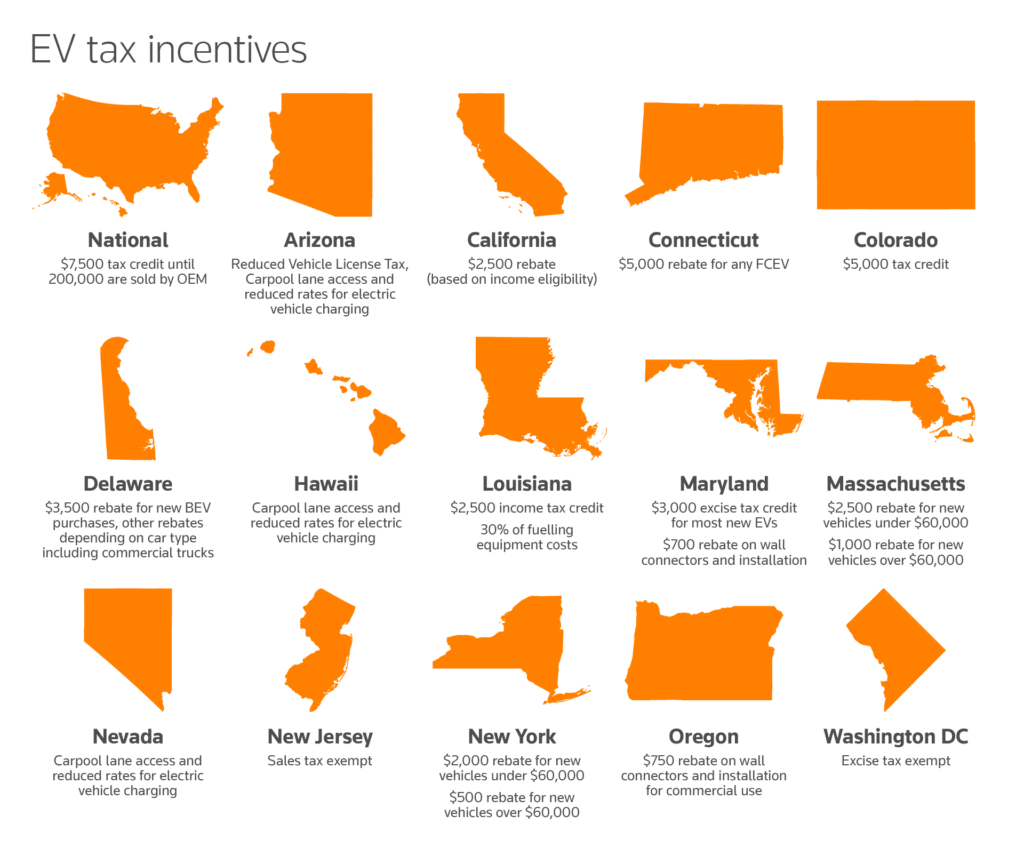

. Used electric car owners can also get a 750 rebate on vehicles costing more than 10000. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Plug-in hybrids get 1000 battery-electric cars can get a 2000 rebate and hydrogen fuel-cell cars are eligible for 4500.

Compare electric cars maximize ev incentives find the best ev rate. Even if a person legally owns his. This rebate is only for customers of Southern California Edison if thats you youll get 1000 if you purchased or leased your car on or after January 1st.

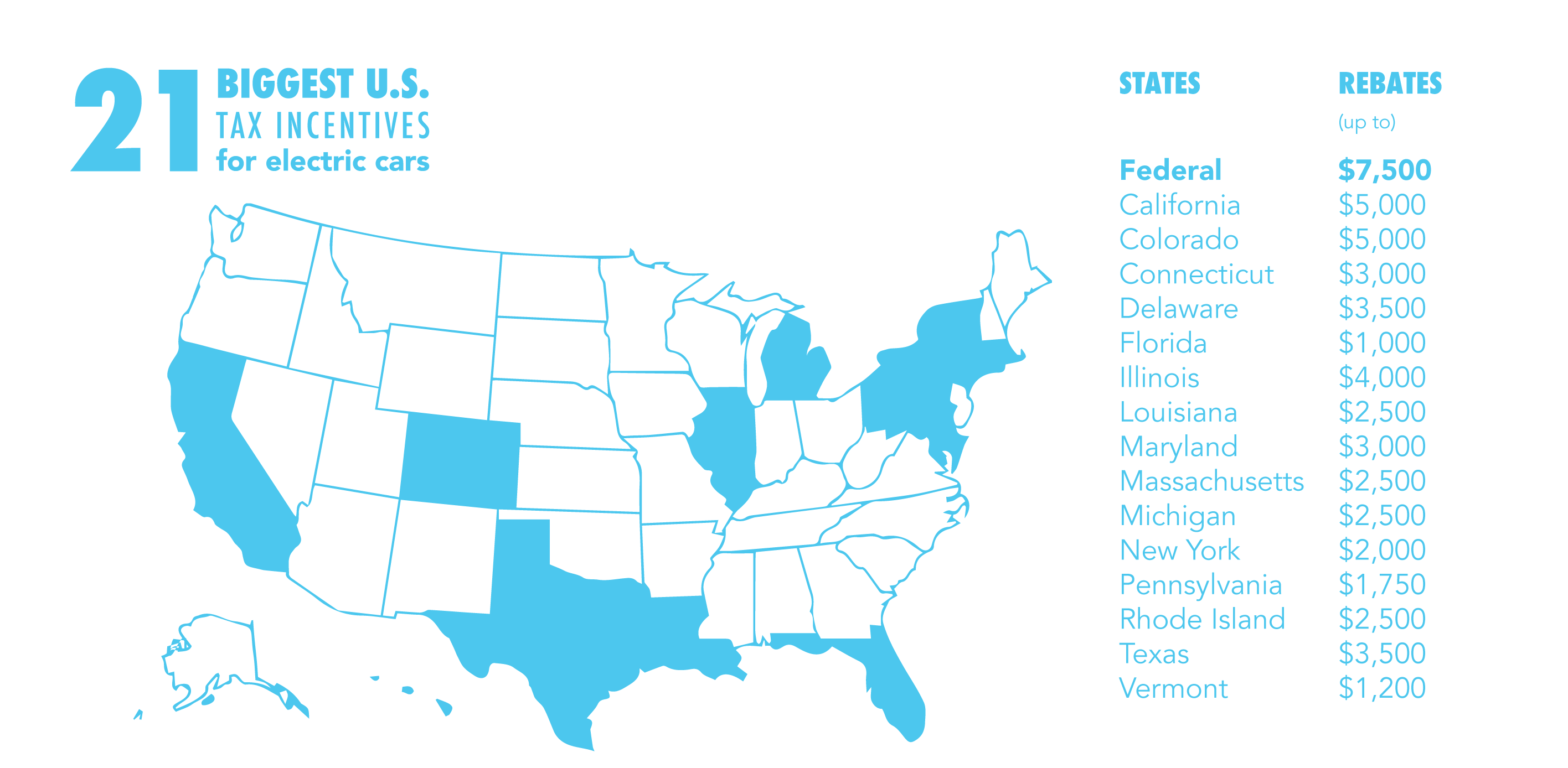

If you purchase a qualifying electric car youll be able to claim up to 7500 in federal EV tax credits against the federal income taxes you owe. Standard Rebate of 2500 for purchase or lease of a new electric vehicle with a base price under 50000. Unlike the federal tax credit the California rebate comes.

Plug-in hybrid vehicle drivers of new leased or used cars can also obtain up to a 750. Theres an EV for Everyone. Southern California Edison Up to 1000.

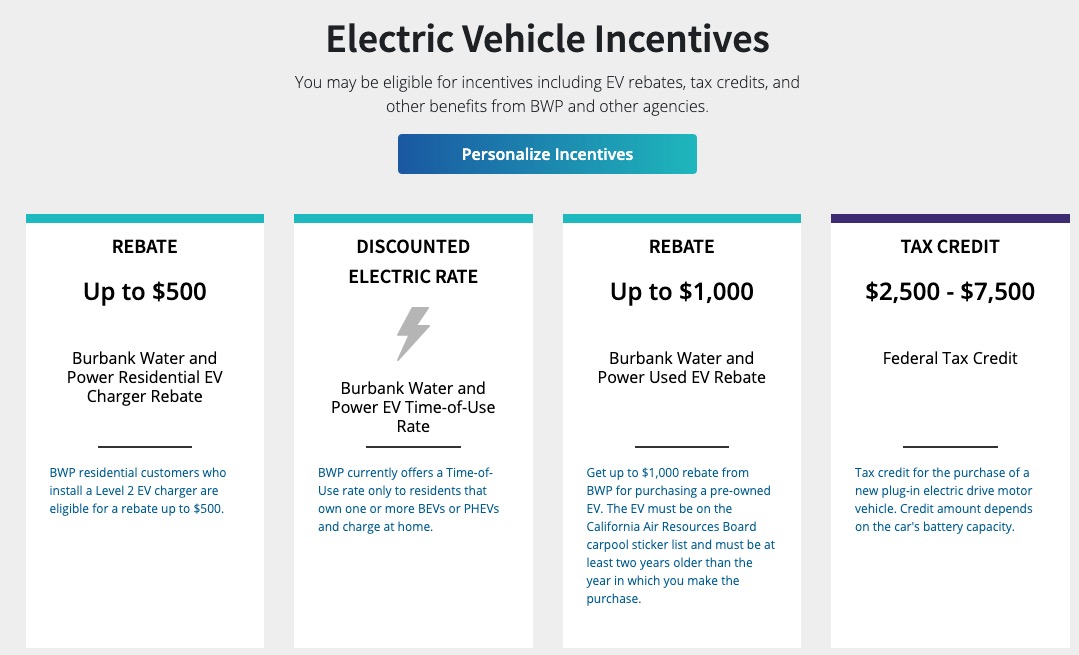

Electric vehicles are gaining popularity and market share. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. The federal government provides a substantial tax credit for new battery electric and plug-in hybrid electric vehicles ranging from 2500 - 7500 depending on the capacity of the electric.

The California Air Resources Board offers point-of-sale rebates of up to 750 for the purchase or lease of a new all-electric or plug-in hybrid electric vehicle through the Clean Fuel Reward. Compare electric cars maximize EV incentives find the best EV rate. The Plug-In Electric Drive Vehicle Credit 30D provides credit between 2500 and 7500 in nonrefundable tax credit for qualifying vehicles.

Again you wont currently find many options in that price range. Find every electric car rebate through our EV incentives tool. Over 9000 in California EV rebates and EV tax credits available.

4500 for fuel cell electric vehicles FCEVs 2000 for battery electric vehicles 1000 for plug-in hybrid electric vehicles PHEVs and 750 for zero emission motorcycles. Clean Cars 4 All which only serves residents in the states most polluted regions has taken 12800 pre-2007 model year cars off the road since its launch in 2015. You can only claim this rebate in the year in.

Vehicle tax credits and rebates. Californians who purchase electric vehicles can get incentives ranging from 750 all the way up to 7000 from the state thanks to the Clean Vehicle Rebate Project and the. All electric vehicles must have been.

Due to California EV rebates high cost and popularity they installed an income limit of 150000 for an individual or 300000 for joint filers. Plug-in hybrids with electric ranges under 35 miles. Over 9000 in california ev rebates and ev tax credits.

The incentives are up to a whopping 9500 towards the purchase of a new or used plug-in hybrid electric vehicle PHEV fully battery electric vehicle BEV or fuel cell electric. The credit covers up to 30 of the purchase price and is capped at a maximum of 4000. New electric vehicles are eligible for up to a 7500 Federal EV tax credit depending on the model and is eligible for 5000 in California state electric vehicle grants.

For those that qualify Besides the generous credit for a LEVEL 2 home charger. In Q2 2022 EV sales accounted for 56 of the total auto market up from 27 in Q2 of 2021Clean energy and.

Ev Tax Credit 2022 Updates Shared Economy Tax

Toyota Mirai 7 500 California Tax Credit Eligibility Toyota Of Hollywood

California Electric Car Rebate Everything You Need To Know

Climate Bill Would Create Roadblock For Full Ev Tax Credit E E News

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Most Electric Vehicles Won T Qualify For Federal Tax Credit Abc News

What Car Buyers Should Know About The Coming Tax Credits For Evs Los Angeles Times

Jaguar I Pace Tax Incentives Electric Vehicle Tax Credits In California

Toyota S Federal Ev Tax Credits Are All Dried Up

Proposed Electric Vehicles Tax Credit Prioritizes Labor Unions Over Carbon Reduction Goals Reason Foundation

What The Inflation Reduction Act Means For Electric Vehicles Union Of Concerned Scientists

21 Biggest Us Tax Incentives For Electric Cars

California S Ev Rebate Changes A Good Model For The Federal Ev Tax Credit Cleantechnica

Plug In Electric Vehicles In California Wikipedia

Presentation California Plug In Hybrid Electric Vehicle Consumers Who Found The U S Federal Tax Credit Extremely Important In Enabling Their Purchase Center For Sustainable Energy

Do I Qualify For Ca Ev Rebates Chevy Ev Sales In Lodi Ca

These 34 Electric Cars Won T Qualify For Biden S New Ev Tax Credits Carscoops